Many a times, we hear complaints from tax-payers that the processing of their income tax refund has been delayed by the income tax department. This article attempts to address what can be done in such cases.

Income tax refund usually depends on the amount of refund and the source of income. In our experience, we have seen that smaller refund amounts are disposed of very quickly. Also refunds with respect to salary income are disposed of quickly.

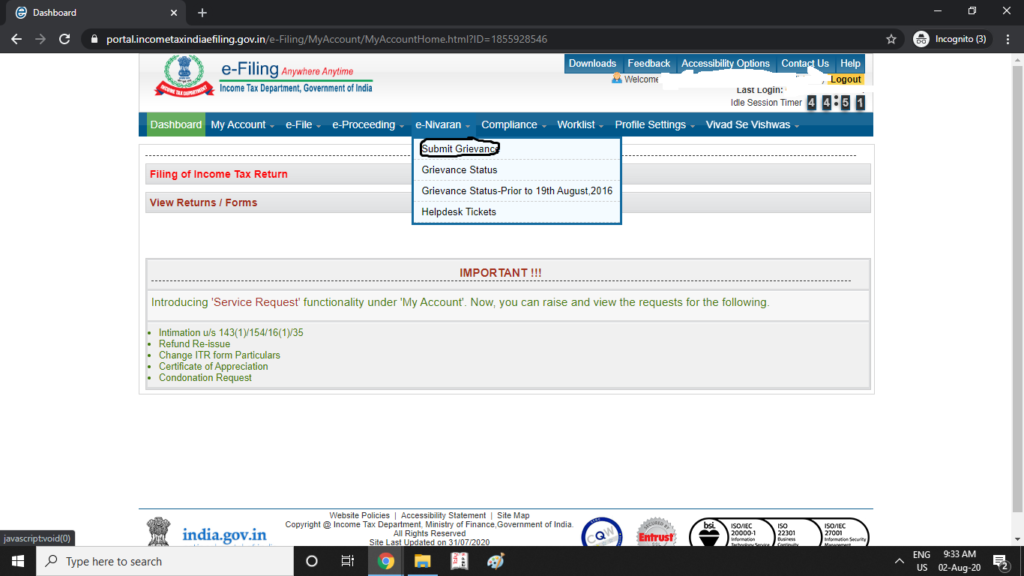

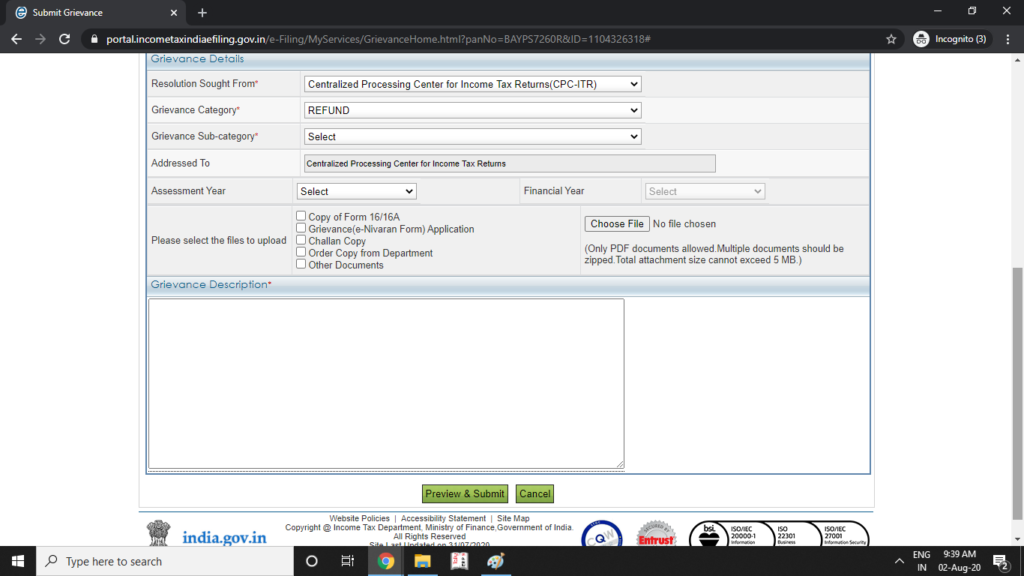

I would suggest to wait for at least 2 months before initiating for refund. If you feel, its taking longer, than you can login to your account on the income tax portal on http://incometaxindiaefiling.com and on the e-nivaran tab , select the submit grievance and select the grievance as Refund related.

In the grievance description section, give details and request for an early resolution. Mention any reasons why you require an early refund as well.

(above selected items in the drop-down fields are for illustrative purposes and will depend on the situation in your specific case)

Submitting a grievance does bring attention of the authorities to your issue.

If you are still not satisfied, then you can file a Right to Information requesting information about the delay in processing the same. The same can be filed online using the Right to Information portal – https://rtionline.gov.in/

Tips for RTI – give complete details, keep request simple asking for information about delay in processing of the same and your RTI request should be ain a formal polite language.

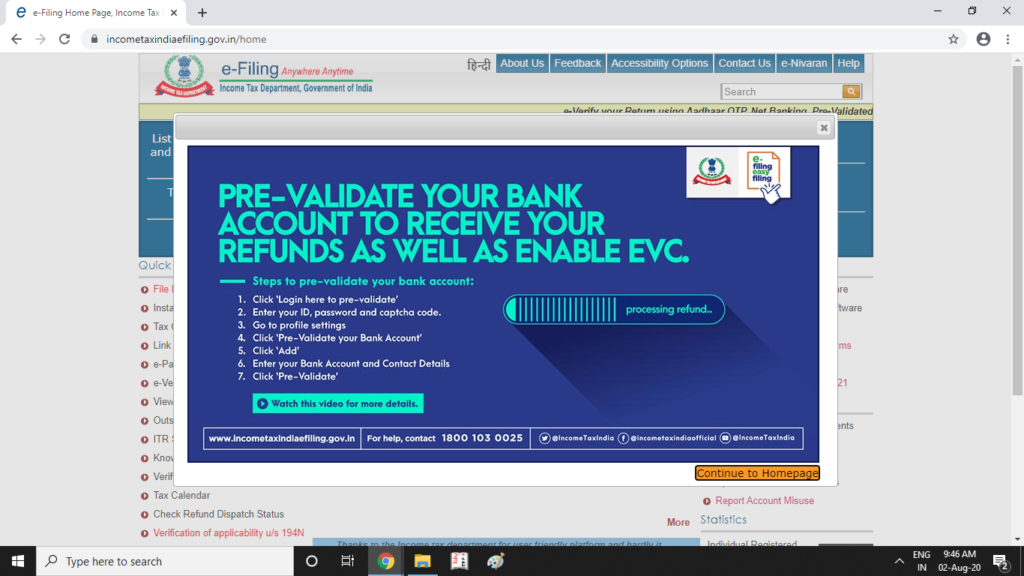

One more thing, do pre-validate your bank details at the earliest because many a times, refund is sanctioned but not processed because the bank account was not pre-validated. Income tax department specifically requires this now.

You can pre-validate the bank account by logging into your income tax portal and going to your profile settings.

On another note, please note that there is a citizens charter for all income tax payers which mentions that if there are no other issues like past disputes or demands from income tax department, the income tax refund should be sent to you within 6 months of filing the income tax return. You can find it here:

https://incometaxindia.gov.in/Documents/citizen-charter-declaration.pdf

This was earlier a recommended one but now, I believe, this has statutory/legal backing and you can use it to obtain your refund.

Disclaimer: The above answer is a non-legal general opinion expressed on an open platform. It is not meant to be actionable since it’s not based on complete knowledge of facts and situations. The author of this answer is not liable for any action taken on the basis of the above answer. Readers are advised to take specific written opinions based on full disclosure of all relevant facts.