Process is the same as GST registration at any place in India. You need to go to http://gst.gov.in and select on Tax-payers : Register now and follow the process. The first time, there will be an opt to verify the email id and mobile number given. Once thats done, you will get a temporary reference number (TRN). Next time you can use the TRN and fresh OTP to login and fill in all details.

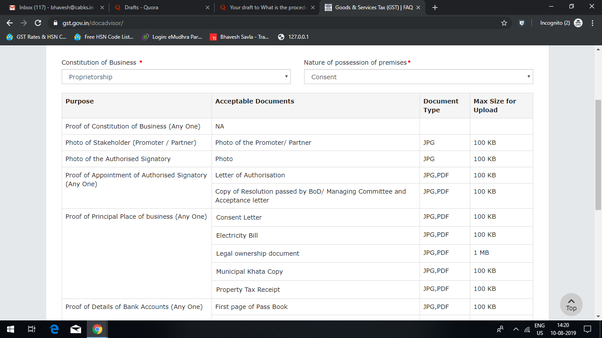

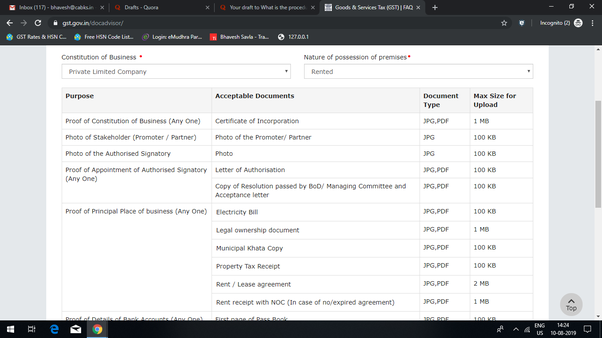

You need to keep ready the following documents:

Please note that not all the documents are to be given but only relevant documents need to be given. For example, for address proof, if the address has been taken on lease basis, then the leave and license agreement is sufficient but if its owned, then ownership documents will need to be attached.

Also, authorised signatory, in case of proprietor can be the proprietor himself but in case of partnership or LLP or Companies, a board resolution or Authority Letter shall be required.Also note that now bank details is not required to be filed prior to registration but can be filed after registration is obtained.

For a private limited company/ Public Limited Company/ Foreign Company or LLP, additional documents pertaining to constitution of business shall be required as follows (Certificate of incorporation)

Also note, that there is some other information not mentioned here but are optional and depend on whether the registration has been taken like Import- Export Code, Professional Tax registration etc.

Please note Digital signature is mandatory for (i) Public Limited Company, (ii) Private Limited Company, (iii) Unlimited Company; (iv) Foreign Company; (v) LLP; (vi) Foreign LLP; (vii) Public Sector Undertaking. In such cases, all other modes of submission will be disabled by the system.

Verification:

The first time, you submit the application, it will verify all PAN numbers from CBDT database and if correct, a ARN is generated. If PAN number is not validated, then you have to again enter the names of the proprietors/ partners/ authorised signatories/ Directors in the manner as recorded in income tax database. (Means the first name , middle name and last name should be same as income tax database).

After verification:

You will receive a response from the tax authorities within 3 common working days on the status of your application. It will either be approved or the assessing officer will raise a Notice Seeking Clarification in case they have any queries w.r.t. the application and/or documents provided. Either way, it will be communicated to you via e-mail. In the later case, you get 7 days to submit necessary documents or make changes. If accepted by the officer, you will get the registration certificate by email.